Offset account: Think of it like this; Interest saved is better than interest earned.

Let me explain

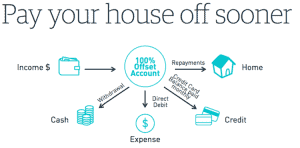

An offset account is effectively like having a normal transaction savings account except it doesn’t earn any interest.

This differs to a regular interest earning transaction bank account which might receive say 1% interest on the balance of savings it holds.

This type of account will never be attached to any type of home loan

The offset account means it always linked to a home or investment loan and its balance of savings offsets the loan balance.

This means will only be charged interest on the difference between the amount of the loan and the amount in your offset account.

For example, let’s pretend you have a $300,000 mortgage at say 4% interest rate and your offset holds $10,000.

You will only be charged interest on $290,000. This saves you money in the form of interest you didnt have to pay!

Mortgage interest is calculated daily so the longer you can leave as much money in the offset account, the better.

Part of the process on your journey with Self- Funded Freedom will be to introduce you to variety of interest saving measures to easily & successfully save significant amounts of interest long term thereby reducing any mortgage by many years.

Own a brand new investment property for $30/week

Ask us how